I’ve always been semi-responsible with money – or so I thought. In college, I didn’t sign up for a million credit cards because they were being offered or because I needed extra money for Bonnaroo. However, within the last year or so I’ve become really serious about transforming my financial situation.

I’ve always been semi-responsible with money – or so I thought. In college, I didn’t sign up for a million credit cards because they were being offered or because I needed extra money for Bonnaroo. However, within the last year or so I’ve become really serious about transforming my financial situation.

Debt free by 30 is my goal!

At the beginning of the year, I paid off one super high-interest credit card and it felt amazing!! Everyone should have the feeling so let’s talk about transforming your finances.

Transforming Your Finances

The debt snowball method Vs The debt avalanche method

You may have heard of these two methods. I’m not going to persuade you that one is better than the other because honestly either way you’re being proactive and taking a step toward being debt free. You get a round of applause from me either way. But here’s the difference:

With the debt snowball method, you pay off your debts from smallest balance to largest balance, regardless of interest rates. With the debt avalanche method, you pay your debts from highest interest rate to lowest interest rate, regardless of balance. I’m not a math wiz, but in case you care, mathematically the avalanche method makes the most sense.

Here’s what I would consider:

The snowball method gives you small wins. Think about all the little statements you have every month: doctor’s bills, store credit cards, etc.. For me it’s my Victoria’s Secret, Express, and Ashley Furniture cards, in addition to the two credit cards I have.They’re not significant debts by any means, but lots of little minimum payments. When you pay your debts from smallest to largest balance you start to clear those little debts away very quickly- which can be motivating. The avalanche method makes sure you’re paying less in interest thereby saving you more money.

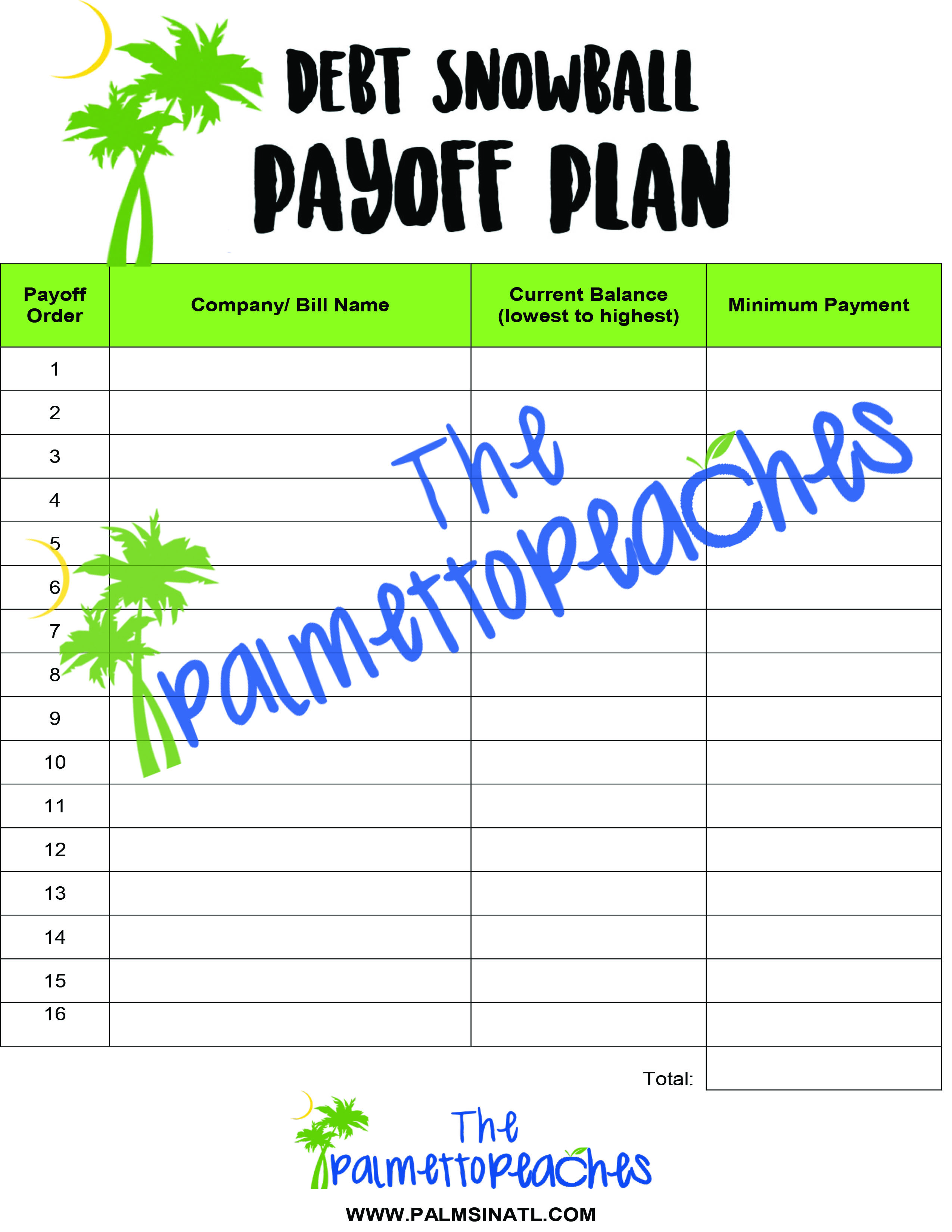

I’m in need of some motivation so I’m going with the snowball method. I’ve got two printables below if you’d like to try it as well.

Debt Snowball

- List all of your debts from the smallest to the largest and include the monthly payments on the payout plan printable

- Make minimum payments on all of your debt except for the smallest. For the smallest debt, you will make the minimum payment PLUS extra money monthly. Adjust that extra amount based on what you can afford keeping up with all of your other payments.

Here’s an example:

-

Express – $450 ($25 per month)

-

Discover Credit Card #1 – $750 ($40 per month)

-

AMEX #2 – $1300 ($60 per month)

-

Car Loan – $8430 ($400 per month)

-

Student Loan – $30,000 ($200 per month)

In this example, the Express card is the smallest, so you would make the minimum payment of $25 a month with an additional $50 per month – that’s $75 all together, mathletes). With this method you are paying more than the minimum due and cutting the debt down faster. If you’re consistent (and aren’t adding to you balance) in about six months (this all depends on your interest rates) your debt will be paid off.

Next Step in the Debt Snowball

The next step is to add the $75 you were paying on the Express card to your next smallest debt. So in this example, it’s the Discover credit card. For six months you made the minimum payment of $40, but now you’ll pay $115. Again, this varies by your interest rate, but within another six months you can pay of this card. So in this example you’ve wiped out two credit cards in a year.

Click on the thumbnails below to download copies of the two worksheets.

I’m not a financial adviser, but hope this method can work for some of our readers. Feel free to share what other methods you’re trying or completed to reach your goals in the comments below. Good luck to everyone with transforming your finances!